As a business, your ability to maintain cash flow is dependent on timely settlement of unpaid invoices by your customers. Without revenue coming into your business, there may not be enough capital to pay suppliers, fund ongoing operations and cover overheads.

Unfortunately, however, some customers/clients do not settle their accounts prior to an invoice’s deadline. To ensure that your cash flow keeps on coming in, you need to have collections systems in place. Without them, your business risks its growth potential and even survival.

To help you, we’ll outline the six simple steps involved in getting unpaid invoices paid.

Unpaid Invoices: The actual cost on a business

The actual cost of an unpaid invoice is actually more than just the value of the invoice itself. Here in New Zealand, the standard terms on a business invoice is between 21 and 30 days, which considering the fact that electronic invoices and payment systems have advanced so much is more than enough time.

Despite that, according to reports, late invoice settlement costs firms in New Zealand up to $456 million a year; 37% of invoices remain unpaid after 30 days, 6% after 60 days, and 2% after more than 90 days. That’s almost half of all business invoices being paid after the due date!

The costs of unpaid invoices include the wasted time, energy and opportunity costs collecting the payment. This same investment of human resources could have been better spent in daily operations and other new revenue generating activities.

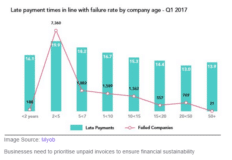

In 2017, a MYOB study showed the correlation between average late payment times and company failure rates in Australia – a trend which is certainly reflected in New Zealand as well.

Collecting Unpaid Invoices in 6 Simple Steps

When a customer has failed to settle an invoice on time, you need to take action. Unfortunately, the reality is that the longer the invoice goes unpaid, the less likely it is that the amount owed is actually going to be settled.

To help you with this challenging obstacle, here’s a six step plan for collecting payment on unpaid invoices without damaging either your reputation as a business or the ongoing relationship with the customer in question.

Step 1 – Include a late payment fee

Including a penalty fee for late payments is a fair and reasonable way to motivate customers to pay your invoices faster. Additionally, the penalty can contribute towards offsetting the time and expense spent on your side by having to collect on the invoice.

However, it is important to note that late payment penalties cannot be charged without prior agreement and consent at the start of the contract. It needs to be included in the original terms with the date from which it will go into effect.

A professional tip for dealing with the discomfort of introducing a late payment fee is to do so in tandem with an early payment discount. For example, many companies will offer a percentage discount on the value of the invoice if it is paid within a certain time period, such as 10 days of the invoice being issued.

Step 2 – Follow up on unpaid invoices in writing

If the deadline on an unpaid invoice is imminent and the invoice remains outstanding, a polite, written email reminder should be your first port of call.

In some instances, the reminder will be welcome. They may have simply forgotten or had an accounting issue on their side. A friendly reminder can be a good way of showing your customer goodwill by taking initiative to help them settle outstanding accounts. The more you are able to foster a deeper, stronger and more trusted relationship with your customers the better for your business’s long term growth.

Step 3 – Issue a Statement of Outstanding Cost

Sending a written and professional statement of outstanding cost if an invoice is still unpaid is the next step in collecting debt. The statement should succinctly explain that the invoice is overdue and if there are prior-agreed late penalties, these should be outlined as well.

You may want to consider outlining alternative payment methods to help your customer seamlessly settle the invoice as well.

Step 4 – Contacting the client by phone

At this point, despite it being much more difficult, you will need to call your customer rather than send another written email or letter. Begin the conversation by confirming if the customer received your previous emails/letters and ask if there was an issue in understanding or paying the provided invoice. If there is a problem, you can provide clarification and assistance on the spot.

In the event that the client is struggling due to cash flow issues on their end to settle their account, you may want to offer them a payment plan that works for both parties. This payment plan should be documented and confirmed in writing to ensure you and the customer agree over how much will be paid over what period.

In some instances, neither of these options will work. In other instances, the customer may simply ignore your attempts to call. If this is the case, then you may need to consider Steps 5 and 6.

Step 5 – Contact a collections agency or invoice finance facility provider

At this point, it can be difficult to chase up on an unpaid invoice without ruining your relationship with your customer or damaging your reputation as a business. So, the two best options available are: Debt collection or invoice finance.

Debt Collection Agency

These agencies are experts at recovering outstanding payments. In essence, they provide payment collections services to allow you to focus on the operations and growth of your business. Aside from their experience and expertise in debt collection, even simply informing customers that you intend on engaging an agency can prompt payment.

Invoice Finance

Alternatively, invoice finance can help SMEs unlock tied up capital in unpaid invoices. This service provides an advance on up to 95% of the value of your outstanding invoices using those same invoices as collateral. Once the invoices have been paid, you receive the remaining balance less any associated fees.

If this seems like a solution you’d be interested in exploring, reach out to your nearest ScotPac New Zealand office.

Step 6 – Seek legal assistance

If none of the steps and options above work for your business and situation, you may need to consider professional legal advice. There are obviously going to be fees involved in this route, so you may need to weigh up the costs and benefits of this option. Remember, that there are a lot of factors at play here: contracts in place, sole traders vs companies etc.

Writing off smaller invoices can often be more cost-effective and smarter in the long run. If you do want to pursue some sort of legal action against smaller disputes, make sure to visit the New Zealand Tribunal website for more information.

Ensure Prompt Payment with ScotPac

ScotPac is a leading provider of numerous business financial solutions throughout New Zealand and Australia. While the steps outlined above can help you recover outstanding invoices, often the best solution is to avoid cash flow issues altogether.

To find out more or arrange a consultation with one of our specialists, contact us today.